Fair to lender. Fair to borrower.

New Age Credit Management Platforms driven by Compassion, powered by AI.

ICanPe is your AI-Powered Credit Management Platform for Automated Collections and Settlements.

We seek to disrupt early arrears management and NPA recovery for lenders.

We do so in a manner that respects the borrower’s choices and her right to privacy.

But what is the need?

Despite heavy investments in recovery operations, lenders across the globe continue to face mounting losses.

In India alone, bad debts account for nearly 10% of all bank loans in 2019.

At ICanPe, we are solving the debt recovery problem

by building the next generation

Debt Recovery-As-A-Service (DRAAS)

platform that is both:

Intelligent

Empathic

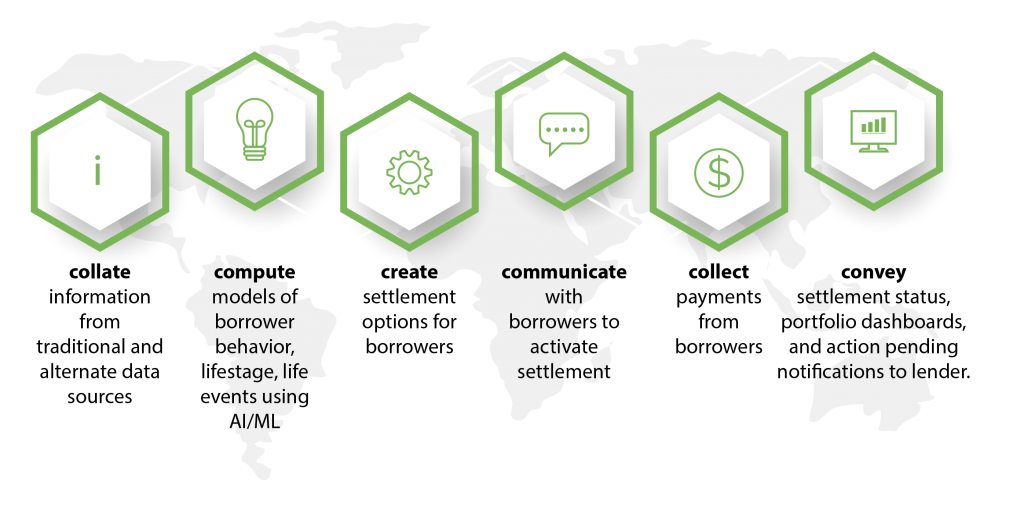

The ICanPe platform utilizes a 6-step process to convert default information into executable recovery strategy and measurable outcomes

Our engine derives its strengths from a combination of :

- Advanced models from Consumer science, and Marketing science

- Theory and research from Behavioral economics

- Algorithms and research from AI & Machine learning

- Heuristics from the Lending domain

- Computational science backend

- Scalable & robust software engineering choices

And above all, Empathy for borrowers

Arindam Choudhury

FOUNDER and CEO

An accomplished industry expert, Arindam has advanced degrees in machine learning and computational sciences from renowned universities in India, UK and Europe. He brings over 18 years of real-world experience in prototyping, building and industrializing data-driven products and solutions for clients across the globe.

Want a demo? Sign up now.